Account Payable Manager of Exela Enterprise Solutions

Home / Solutions / Financial Controls Management

Finance Accounts Payable Software

$0.00

Accounts payable is a central aspect of any finance or accounting program. LogicManager's robust Accounts Payable software features are bundled into one comprehensive solution package to help you create efficiencies and set your business up for financial and overall success.

REQUEST FREE DEMO

LogicManager's Accounts Payable Solution

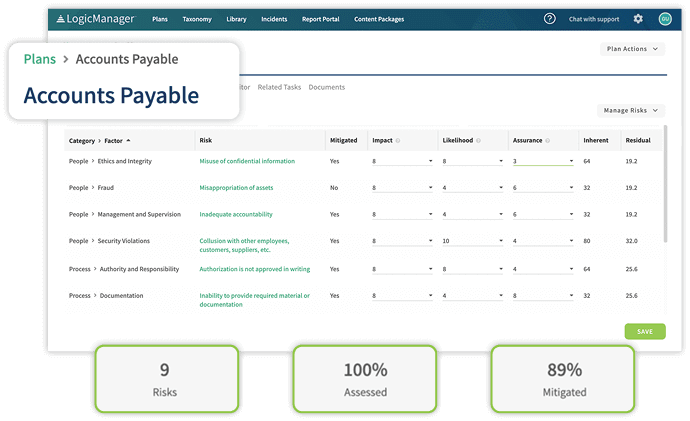

Manage your accounting risks with LogicManager's Accounts Payable solution package:

- LogicManager can seamlessly integrate with virtually any ERP platform. ERP systems record risks that have already happened, while LogicManager manages all the risks that have not yet happened so you can prevent the negative impact of risk by providing better governance over financial controls within your operations.

- Increasing control effectiveness over the accounts payable process and engaging team members throughout your organization can manage the risks between departments. Through LogicManager's task functionality, you can route invoices for process owner approval with full transparency and easily engage with vendors and internal stakeholders to swiftly resolve the issue.

- LogicManager's complaint management forms can be leveraged to uncover fraud, abuse and waste from employees, customers and vendors. This may include payment discrepancies, mismanagement of contractual agreements and compliance complaints. By collecting data and automatically engaging the relevant parties through automated tasks, you can ensure that all potential risks are identified and adequately controlled for.

- By syncing your ERM and ERP systems together, you can ensure that you aren't being billed for services that are no longer being leveraged. Through LogicManager's workflow functionality, as contracts are coming up for renewal, you can automatically engage the process owners to confirm whether or not they are still going forward with a particular service. If they are not, this information can flow into your ERP system to ensure that the accounts payable team is aware of this and that if an invoice for this service is received, it should not be fulfilled.

- By creating a centralized process for housing all of your vendor risks, you are able to ensure that you are meeting auditing deliverables. LogicManager automatically collects a full audit trail to detect altered records, including things such as when contract values are or terms like staff licensing are changed over time.

- Through LogicManager's incident/ event management function, the Audit team is able to examine filed claims for validity, as well as leverage a whistleblower form to identify potential kickbacks and bribery, track any customer complaints back to the vendor that they may be stemming from, and more.

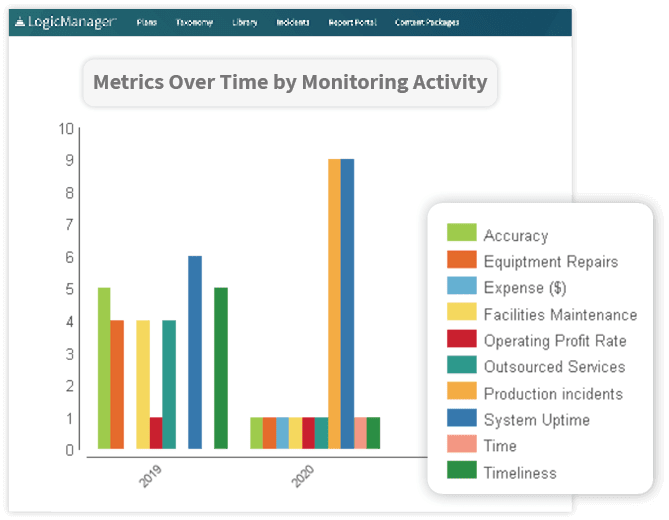

- Through our reporting tools, aggregate all accounts payable information to easily see any outstanding payments, trending patterns or mismanaged vendors. Reports commonly used for accounts payable include:

- Contracts Expiring in the Next 90 Days – This displays contracts that are expiring in the next 90 days and highlights areas based on how far out the expiration and notification dates are. This report is optimal for Excel, where you can then filter and sort as needed.

- Overdue Tasks – This report shows overdue tasks within LogicManager, including who is responsible for those tasks. It's also compatible with Excel.

- Incidents Dashboard – Get a graphical representation and summary overview of your incidents with this dashboard style report.

Request a Free Demo of LogicManager's Accounts Payable Tools

Benefits of LogicManager's Accounts Payable Software

Manage Risk

According to a January 2021 Harvard Business Review report, the failure rate for mergers and acquisitions (M&A) is 70-90%. The risk of your vendor to your organization is more than what you pay them. LogicManager has robust risk ratings assessments that provide a holistic view of your vendor risk, including credit rating changes, security, financial impact, technology, business continuity and data integrity among others. Additionally, integrating with LogicManager's vendor management platform provides Finance and other stakeholders with notifications when a risk profile of a key vendor changes.

Separation of Duties

Separation of duties is critical to controlling fraud, abuse and waste. When your contract officer signs the vendor agreement, ACH or wire transfer payment details are automatically set up or updated in your ERP system. Finance staff separation of duties controls should be enforced through automation to avoid the same people entering the payment information in your internal system of record and the banking payment system for accounts payable transactions.

Streamline Vendor Onboarding & Offboarding

Tasks and automated workflows manage your vendor onboarding process from initial request, to risk rating, due diligence collection and SME reviews to ensure that all vendor risks are identified and appropriately mitigated. This also ensures that Accounts Payable is kept in the loop as new vendors are approved and will be invoiced for. Additionally, you can leverage workflows to manage your vendor offboarding process to ensure that Accounts Payable is automatically notified when a vendor is not going to be leveraged going forward.

Strengthen Vendor Accountability

Sign-offs for vendor renewals by Finance of the users of a key product or service requires the coordination of multiple stakeholders – and Finance is often in the uncomfortable position of chasing down SLA performance, contract term verifications, legal reviews, pricing changes, process owner approvals and budget approvals. LogicManager automates this process with rules and workflows that provide transparency and accountability for all stakeholders in a timely and predictable manner.

Prioritize resources

At the end of the day, your bank risk assessments should give you a better understanding of what each branch is up against. This will allow you to appropriately allocate resources to reinforce where needed.

Gain More Accurate Data

The root cause of overpayment of vendors is frequently not paying vendors on time. This results in multiple reminder invoices or the invoice amount needing to be validated in the contract without having access to the most recent contract on record. The same is true for name changes or address changes due to mergers and acquisitions of vendors and products. Vendor details and contract information should be standardized and consolidated into a single repository. Your ERP system is not purpose built for contract management and duplication of efforts on payment information, change of address, product and service terms or contractual obligations; it is a waste of resources.

Taking a Risk-Based Approach to Accounts Payable

The risks of waste, fraud, abuse and noncompliance in financial transactions increases unnecessarily when finance lacks transparency and accountability; accountability with vendors, and on behalf of the many stakeholders across the organization that those vendors serve. This can result in preventable financial reporting misstatements, cash flow inaccuracies, contract disputes or even regulatory liabilities.

Accounts Payable is more than just the contractual money owed by a business to its suppliers. Managing financial transactions of an organization and their accounting means identifying the sources of risk in vendor management. These risks are controled by integrating an Enterprise Risk Management (ERM) system to provide a supervisory umbrella over your Enterprise Resource Planning (ERP) system. ERP systems record risks that have already happened, while LogicManager's ERM system manages all the risks that have not yet happened. That way, you can prevent the negative impact of risks by providing better governance over financial controls within your operations.

By gaining transparency across siloed vendor management and process owners, you ensure that your organization is:

- Assessing invoice accuracy and matching against approved purchase orders or contractual terms

- Preventing auto-renewals due to missed contract term notifications, missed negotiation of discounts or overpaying for contractual licenses or services not longer needed

- Staying on top of payment timeliness to prevent late payment fees and missed regulatory obligations

- Integrating the vendor onboarding and offboarding process to avoid fraud, abuse and waste

- Increasing vendor SLA accountability with process owners across the organization that depend on these vendors as part of the accounts payable process

- Preventing financial reporting misstatements

- And more

LogicManager's Accounts Payable solution seamlessly extends your organization's vendor management risk program transparency to avoid fraud, abuse and waste.

What are Accounts Payable Risks?

Without linking your vendor management and accounts payable processes, you are setting your organization up for overpaying vendors, missing renewal pricing discounts or paying for services not used. Separation of duties in the vendor set-up process reduces the risk of fraud. The same is true for Accounts Receivable with under collections and missed opportunities for contractual term negotiation and realignment at renewals.

Consultants and additional FTEs are required to run a due diligence and contract program in the absence of software. Once you factor in the cost of unintended auto-renewals, overpayments and poor expense management of contract terms, expenses and liabilities due to gaps between those in the organization that rely on the vendor, procurement and finance become high. In organizations, avoidable duplicate payments represent about 0.5% of all payments. Although 0.5% doesn't sound like much, it does reflect significant sums at scale. For example, 0.5% of $1B in AP is $5M in duplicate payments going out each year.

Related Financial Content

Request a Free Demo of LogicManager's

Accounts Payable Tools

Accounts Payable Tools

Want to learn how LogicManager's Accounts Payable solution package

can help you prevent risks and transform your finance program today?

Start by requesting a free demo.

Related Packages

Title

My Favorites List

Your Favorites List can be saved or sent to our team of experts at any time! Here are the solutions you've added to your list so far:

Account Payable Manager of Exela Enterprise Solutions

Source: https://www.logicmanager.com/solutions/financial-controls-management/finance-accounts-payable-software/

0 Response to "Account Payable Manager of Exela Enterprise Solutions"

Post a Comment